Newmont Corporation

(NEM)

Price delayed 15 minutes

- Income Statement

- Blance Sheet

- Cash Flow Statement

Financial Statements

- Key Metrics

- Profitability

- Growth

- Valuation Multiples

- Operating Efficiency

- Liquidity & Solvency

- Cash

Ratio Analytics

My Watchlist

Log in to view your watchlist.

Newmont Corporation

(USD)

| Previous Close | 44.47 |

| 52-Week Range | 29.42-58.72 |

| Last Dividend | 1.00 |

| Basic EPS | - |

| Diluted EPS | - |

| Beta | 0.53 |

| Shares Outstanding | 1.15B |

Valuation Multiples

Trailing last fiscal year

| Market Capitalization (USD) | 51.28B |

| Enterprise Value (USD) | - |

| Price/Earnings (trailing) | - |

| Price/Earnings (forward) | 12.33 |

| Price/Book | - |

| Price/Sales | - |

| Enterprise Value/EBIT | - |

NEM vs. Gold Industry

| Firm | Market Cap |

|---|---|

| Newmont Corporation (NGT.TO) | 69.93B |

| Newmont Corporation (NEM) | 51.28B |

| Agnico Eagle Mines Limite (AEM.TO) | 47.51B |

| Barrick Gold Corporation (ABX.TO) | 41.83B |

| Agnico Eagle Mines Limite (AEM) | 34.85B |

| Wheaton Precious Metals C (WPM.TO) | 34.48B |

| Franco-Nevada Corporation (FNV.TO) | 32.52B |

Revenues and Earnings

Last Fiscal Year

| Revenue (USD) | - |

| Operating Income (USD) | - |

| Net Income (USD) | - |

| Operating Margin | - |

| Net Profit Margin | -3.6% |

| Return on Equity | - |

| Return on Assets | - |

Financial Position & Health

Last Fiscal Year End

| Total Capital (USD) | 32.24B |

| Total Stockholders Equity (USD) | 19.35B |

| Total Debt (USD) | 12.71B |

| Debt-to-Equity Ratio | 65.07% |

| Current Ratio | 222.66% |

| Quick Ratio | 110.83% |

| Altman's Z-score | 1.64 |

Cash Flows

Last Fiscal Year

(USD)

| Cash & Cash Equivalents | 2.88B |

| Total Financial Investments | 3.28B |

| Free-Cash-Flows (Unlevered) | - |

| Free-Cash-Flows (Levered) | - |

| Capital Expenditures | 2.32B |

| Cash Interest Coverage | - |

Growth Rates

As of Last Fiscal Year End

| 1-Year Net Income Growth | -136.79% |

| 1-Year Operating Income Growth | -83.85% |

| 1-Year Revenue Growth | -2.51% |

| 3-Year Net Income Growth | -115.29% |

| 3-Year Operating Income Growth | -84.1% |

| 3-Year Revenue Growth | 22.33% |

Company Description

| Exchange | New York Stock Exchange |

| Stock Currency | USD |

| Reporting Currency | USD |

| CIK | 0001164727 |

| CEO | Mr. Thomas Ronald Palmer |

| Full-time Employees | 21700 |

| Street | 6900 East Layton Avenue |

| City, State | Denver CO |

| Country | US |

| Phone | 303 863 7414 |

| Website | https://www.newmont.com |

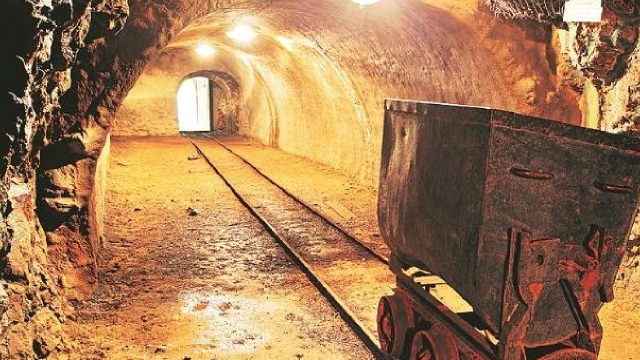

Newmont Corporation engages in the production and exploration of gold. It also explores for copper, silver, zinc, and lead. The company has operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia, and Ghana. As of December 31, 2021, it had proven and probable gold reserves of 92.8 million ounces and land position of 62,800 square kilometers. The company was founded in 1916 and is headquartered in Denver, Colorado.

Newmont Stock Loses 27% in 3 Months: Should You Buy Now?

zacks.com

NEM remains hamstrung by higher production costs, which has contributed to its underperformance.

Very Bad News For Dividend Stocks

seekingalpha.com

Dividend stocks boomed from early July 2024 to late November 2024. However, since then, they have pulled back sharply. I discuss the bad news that may continue weighing on many dividend stocks.

World Metal & Mining ETFs - 2024 Year in Review

newsfilecorp.com

31.Dec.2023 - 31.Dec.2024 228 ETFs Metal ETFs, Miners ETFs, Metal and Miners Hedged & Leveraged ETFsTotal Assets (AUM) ~ $330.7 B USD Toronto, Ontario--(Newsfile Corp. - January 8, 2025) - Total assets for the World's 228 Metal & Mining ETFs finished 2024 at USD $330.7 B. This is an increase of +13.1% from the 2023-year end close of USD $292.4 B.

Newmont Stock: A 'Once-In-A-Generation' Buy 2.0

seekingalpha.com

I discussed NEM's merits as a 'Once in a generation buy' last March. The stock surged by 75% following that article until late October 2024. However, it has recently dropped by over 33%.

Is Trending Stock Newmont Corporation (NEM) a Buy Now?

zacks.com

Zacks.com users have recently been watching Newmont (NEM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Stock Picks From Seeking Alpha's December 2024 New Analysts

seekingalpha.com

In December, we welcomed 29 new analysts to Seeking Alpha and in this article we are showcasing their stock picks and investment strategies. Five buy picks are highlighted on Viasat, Newmont, NeuroOne Medical, X-Fab Silicon Foundries, and ArcerlorMittal. Analysts' recommendations range from Strong Buy to Strong Sell, covering diverse sectors such as healthcare, technology, energy, and consumer goods.

Newmont: This Is How We Are Betting On Gold

seekingalpha.com

Newmont: This Is How We Are Betting On Gold

Newmont Corporation (NEM) Stock Declines While Market Improves: Some Information for Investors

zacks.com

In the latest trading session, Newmont Corporation (NEM) closed at $38.11, marking a -0.68% move from the previous day.

Gold Mining Leaders Barrick, Newmont Sink Deeper As Death Cross Looms

benzinga.com

The glitter of gold is losing its luster for two mining giants, Barrick Gold Corp GOLD and Newmont Corp NEM, as both stocks have hit a technical Death Cross —a bearish signal when the 50-day moving average falls below the 200-day moving average.

Is Newmont (NEM) a Buy as Wall Street Analysts Look Optimistic?

zacks.com

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Newmont: A Safe Bet For My Growth-Heavy Portfolio

seekingalpha.com

Newmont Corporation is a 'Strong Buy' due to its dominant position in gold mining and solid copper exposure, with favorable price forecasts for both metals. The company benefits from operational efficiency, prudent capital allocation, and a strategic portfolio, including the transformative acquisition of Newcrest Mining. Newmont's valuation is attractive, with a forecasted P/E ratio decline and a DCF model suggesting a fair share price of $43.25, indicating 13% upside potential.

Newmont Corporation (NEM) is Attracting Investor Attention: Here is What You Should Know

zacks.com

Recently, Zacks.com users have been paying close attention to Newmont (NEM). This makes it worthwhile to examine what the stock has in store.

Into 2025: Top 8 Stocks I Own And Why (Part II)

seekingalpha.com

2024 is going out with a bang as mystery drones, Federal Reserve hawkishness, and quantum stocks dominate headlines. It's time to look towards 2025 after another banner year for stocks. Here are four stocks in timely, tremendous industries to keep on your radar.

Newmont Files Early Warning Report

businesswire.com

DENVER--(BUSINESS WIRE)--Newmont Files Early Warning Report.

The Federal Reserve Just Gave Dividend Investors A Huge Christmas Gift

seekingalpha.com

The Federal Reserve just cut rates but reduced the outlook for future rate cuts. This sent the market tumbling lower. However, I believe this is a huge gift to dividend investors.

Why Newmont Corporation (NEM) is a Top Value Stock for the Long-Term

zacks.com

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Why The Market May Get Turned Upside Down In 2025

seekingalpha.com

AI stocks have dominated the market in 2024, dragging the S&P 500 higher with them. I think the market may get turned upside down in 2025. I share why and also share some of my top picks for the new year.

3 Growth Stocks to Grab for Less Than $100

marketbeat.com

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

zacks.com

Newmont (NEM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Newmont overhauls leadership, streamlines operations amid challenges

proactiveinvestors.com

Newmont Corporation (NYSE:NEM, TSX:NGT, ASX:NEM, ETR:NMM) has let go of nearly a dozen managers as part of a major corporate restructuring effort, according to Bloomberg. The layoffs include a member of its executive team, Bloomberg reported.

Newmont Stock Skids 30% From Its 52-Week High: Should You Buy the Dip?

zacks.com

While NEM's robust portfolio of projects and a healthy growth trajectory paint a promising picture, its high production costs warrant caution.

Newmont to Sell CC&V to SSR Mining for up to $275 Million

zacks.com

NEM expects gross proceeds of up to $275 million, including a cash consideration of $100 million due at closure.

Newmont Announces Agreement to Divest CC&V for up to $275 Million

businesswire.com

DENVER--(BUSINESS WIRE)--Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM) (“Newmont” or the “Company”) announced today that it has agreed to sell its Cripple Creek & Victor (“CC&V”) operation in Colorado, USA, to SSR Mining Inc. (“SSR”) for up to $275 million in cash consideration. Upon closing the announced transactions, Newmont will have delivered up to $3.9 billion in gross proceeds from non-core asset divestitures and investment sales.1 The transaction is expected to c.

Newmont: A Promising Turnaround Opportunity

seekingalpha.com

Newmont has underperformed due to operational challenges, but improving efficiency and divesting non-core assets present a significant investment opportunity. Despite high All-in Sustaining Costs (AISC) of $1,600/oz in Q3 2024, Newmont is focused on increasing margins through key project ramp-ups. Barrick and AEM reported lower AISCs, highlighting NEM's current inefficiencies but also its potential for margin improvement.

Signal Says Target This Gold Stock Right Now

schaeffersresearch.com

Since running into $2,700 in October, gold prices have cooled off, consolidating below this mark, though still elevated compared to the last 12 months.

Newmont Corporation (NEM) is Attracting Investor Attention: Here is What You Should Know

zacks.com

Newmont (NEM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Newmont: 3 Reasons For Upside After Overcorrection

seekingalpha.com

Newmont Corporation's price decline is an opportunity to buy the otherwise strong stock at a discount. While earnings might have fallen short of expectations in Q3 2024, on their own they are robust, and the outlook for the company and gold prices is positive too. NEM's market multiples indicate the possibility of a doubling in price in 2025, though risks to gold prices should be taken into account as well.

Newmont Corporation: Valuation Is Now More Attractive

seekingalpha.com

Newmont Corporation's recent asset divestitures, including the Eleonore mine sale, are part of a strategy to optimize its portfolio and strengthen its capital position. Despite rising operational costs, Newmont's strong cash flow and revenue growth, driven by high gold prices, make it a compelling buy at the current price. Newmont's valuation metrics, including a low P/E and P/CF ratio, suggest the stock is undervalued, presenting a buying opportunity for value-oriented investors.

Newmont Announces Sale of Eleonore for $795 Million in Cash

zacks.com

NEM believes that Dhilmar, which has extensive experience in gold and copper mining, will be an excellent steward of the asset.

Newmont to sell Éléonore mine for $795 million

kitco.com

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

12% Yield And Big Buyback: Dividend Stocks I Am Buying Hand-Over-Fist

seekingalpha.com

I love stocks that pay big dividends and buy back a lot of stock. I share some dividend stocks that meet these criteria. I detail why they are compelling buys right now.

Is Newmont (NEM) Stock Outpacing Its Basic Materials Peers This Year?

zacks.com

Here is how Newmont Corporation (NEM) and Agnico Eagle Mines (AEM) have performed compared to their sector so far this year.

NEM vs. AGI: Which Stock Is the Better Value Option?

zacks.com

Investors with an interest in Mining - Gold stocks have likely encountered both Newmont Corporation (NEM) and Alamos Gold (AGI). But which of these two stocks presents investors with the better value opportunity right now?

Newmont to Divest Musselwhite Operation for Up to $850 Million

zacks.com

NEM continues to use free cash flow from operations and divestiture proceeds to increase long-term value for shareholders.

Newmont Ontario gold mine sale opens door for further buybacks - analyst

proactiveinvestors.com

Newmont Corporation (NYSE:NEM, TSX:NGT, ASX:NEM, ETR:NMM)'s Musselwhite gold mine sale to Orla Mining is set to open the door for further share buybacks, Jefferies analysts believe. The $810 million sale of the Ontario mine was unveiled on Monday under a wider effort to divest away from non-core assets.

Newmont Corporation (NEM) Is a Trending Stock: Facts to Know Before Betting on It

zacks.com

Newmont (NEM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Buy 5 U.S. Bigwigs on the Dip for Sparkling Returns in the Short Term

zacks.com

Five stocks currently available at attractive valuations after sizeable corrections in prices are: PFE, NEM, UBER, ADBE, QCOM.

Newmont (NEM) Loses -28% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

zacks.com

Newmont (NEM) has become technically an oversold stock now, which implies exhaustion of the heavy selling pressure on it. This, combined with strong agreement among Wall Street analysts in revising earnings estimates higher, indicates a potential trend reversal for the stock in the near term.

Kenorland Announces Follow-Up Drill Program and Commencement of Phase 2 Earn-In by Newmont Corporation at the Chebistuan Project

newsfilecorp.com

Vancouver, British Columbia--(Newsfile Corp. - November 13, 2024) - Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) ("Kenorland" or the "Company") is pleased to announce planning of a winter 2025 drill program at the Deux Orignaux prospect, and that Newmont Corporation ("Newmont") has provided Notice (as defined below), pursuant to the Venture Agreement between Newmont and the Company dated September 4, 2024 (the "Venture Agreement"), to enter Phase 2 of the earn-in agreement to potentially earn an additional 29% participating interest (the "Phase 2 Earn-In") in the Chebistuan project (the "Project"), located in Quebec.

The Zacks Analyst Blog Amazon, KLA, Newmont, Uber Technologies and S&P Global

zacks.com

Amazon, KLA, Newmont, Uber Technologies and S&P Global are included in this Analyst Blog.

5 U.S. Corporate Behemoths to Buy as Short-Term Momentum Plays

zacks.com

We have narrowed our search to five large-cap momentum stocks. These are: AMZN, NEM, KLAC, UBER, SPGI.

Newmont: The Top Risk-Adjusted Gold Miner To Buy Today

seekingalpha.com

Newmont is significantly undervalued, on the latest selloff to $45 per share, given the logic of substantial 2025 gold gains on a looming dollar devaluation. Extensive gold reserves, low production costs, a strong balance sheet and high dividend yield are well worth the price of admission. The company's forward P/E ratio is historically very low, suggesting a 50% discount to its potential long-term value, with a target price range of $90-$100 per share in 18 to 24 months.

Newmont Stock Trading Cheaper Than Industry: Buy or Hold?

zacks.com

With a robust portfolio of projects and a healthy growth trajectory, NEM presents a solid investment case for those looking to capitalize on the gold rally.

Nemetschek price target raised to EUR 125 from EUR 108 at Barclays

https://thefly.com

Barclays raised the firm's price target on Nemetschek to EUR 125 from EUR 108 and keeps an Overweight rating on the shares.

Investors Heavily Search Newmont Corporation (NEM): Here is What You Need to Know

zacks.com

Zacks.com users have recently been watching Newmont (NEM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Is Newmont Undervalued?

forbes.com

Newmont Corporation (NYSE: NEM), the world's largest gold miner, has seen its stock underperform over the last month, falling by 13% compared to the S&P 500 which was up 1.5%. The decline in stock prices has been primarily due to the stellar performance being expected due to rising demand of gold, amidst uncertainties surrounding the U.S. Presidential elections.

Newmont Files Early Warning Report

businesswire.com

DENVER--(BUSINESS WIRE)--Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM) (together with its affiliates, “Newmont” or the “Company”) announced today that Newcrest Canada Holdings Inc. (the “Vendor”), a wholly-owned subsidiary of Newmont, sold all 14,674,056 common shares of Azucar Minerals Ltd. (“Azucar”) held by the Vendor to Almadex Minerals Ltd. (“Almadex”) and certain directors and officers of Azucar (collectively with Almadex, the “Purchasers”), for an aggregate purchase pric.

Here's Why Newmont Corporation Stock Fell 15% in October

fool.com

Rising costs are preventing this mining company from cashing in on rising gold prices.

Brokers Suggest Investing in Newmont (NEM): Read This Before Placing a Bet

zacks.com

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

NEM or AGI: Which Is the Better Value Stock Right Now?

zacks.com

Investors looking for stocks in the Mining - Gold sector might want to consider either Newmont Corporation (NEM) or Alamos Gold (AGI). But which of these two companies is the best option for those looking for undervalued stocks?